3 Bullish Candle Pattern

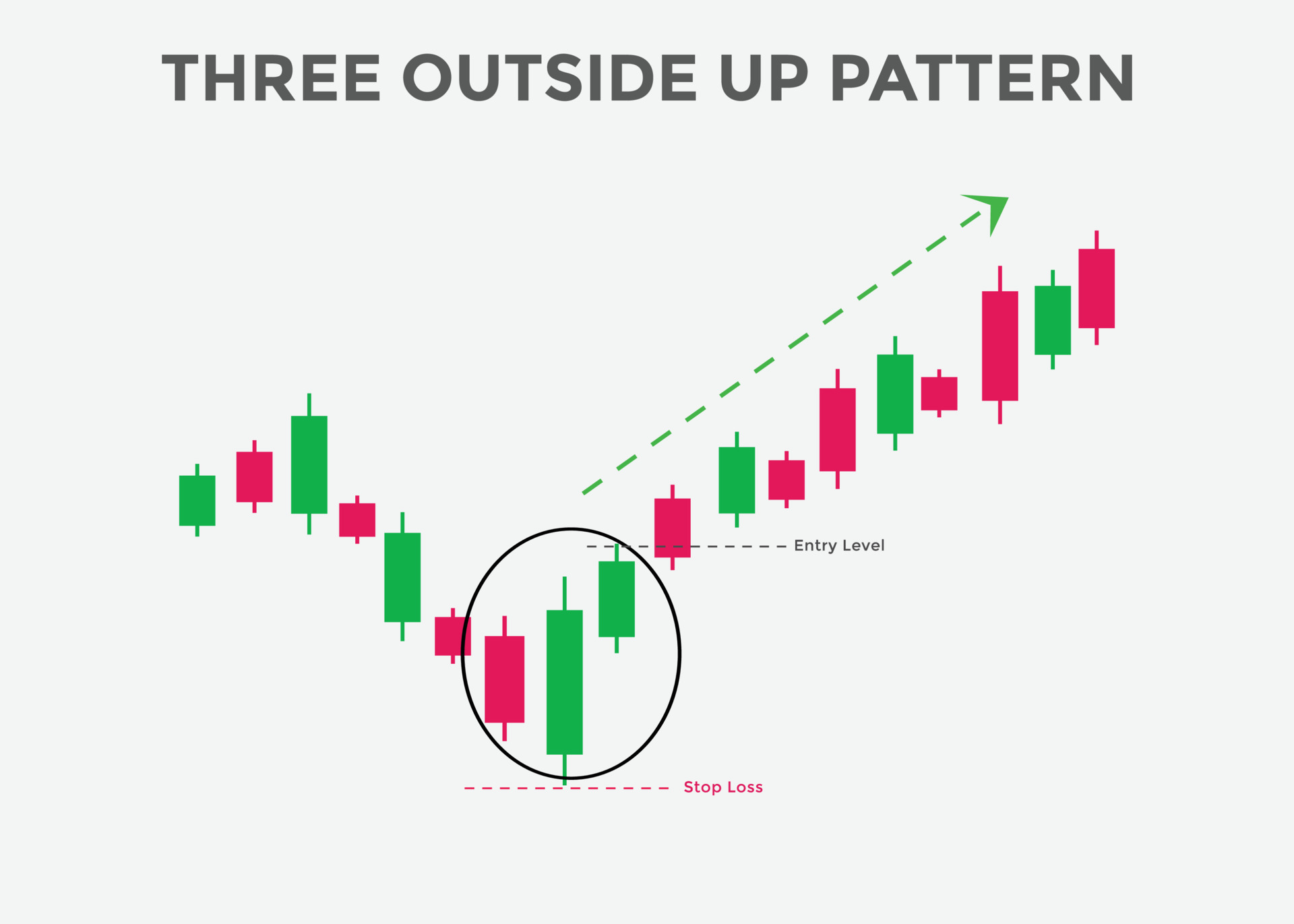

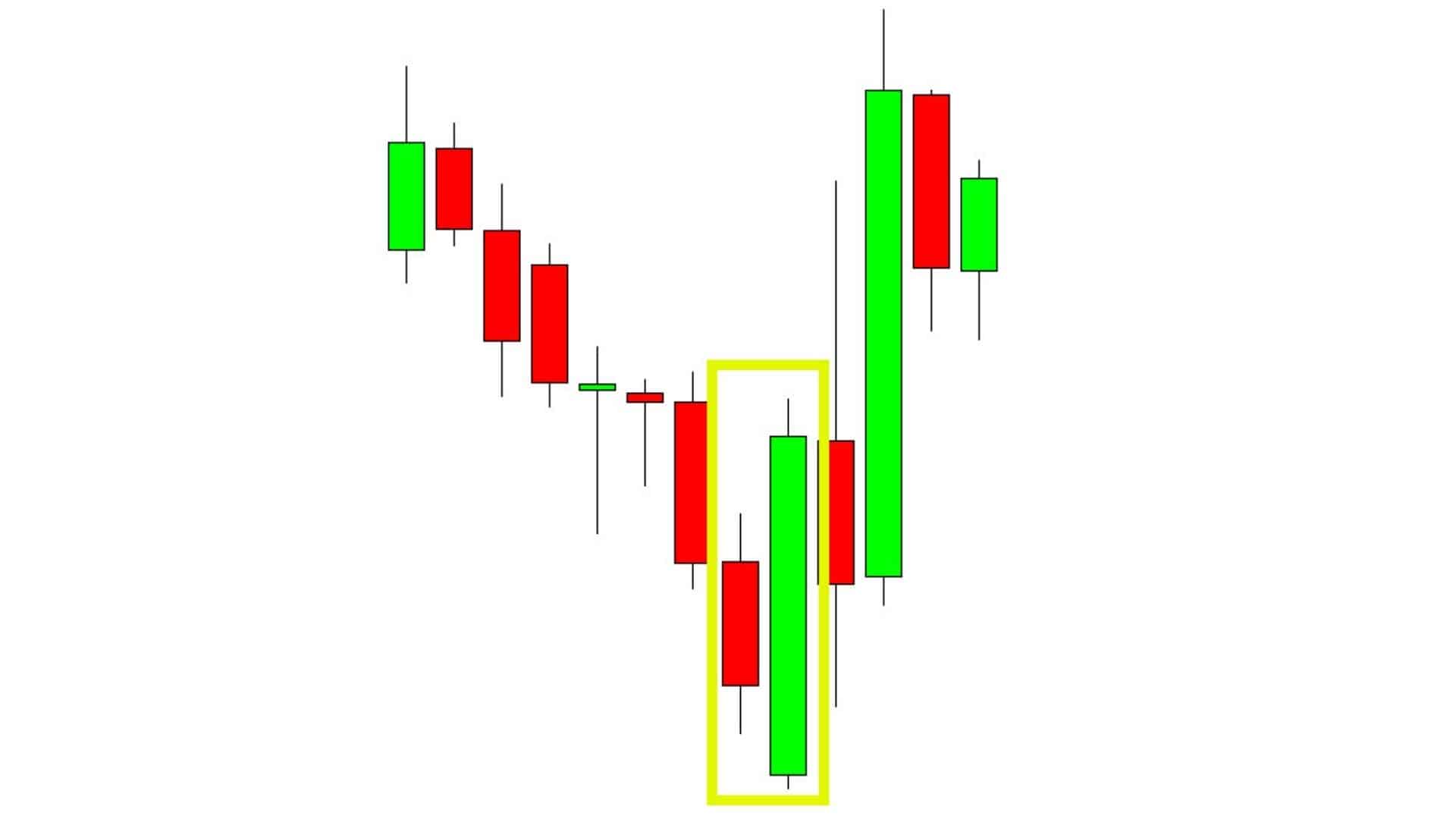

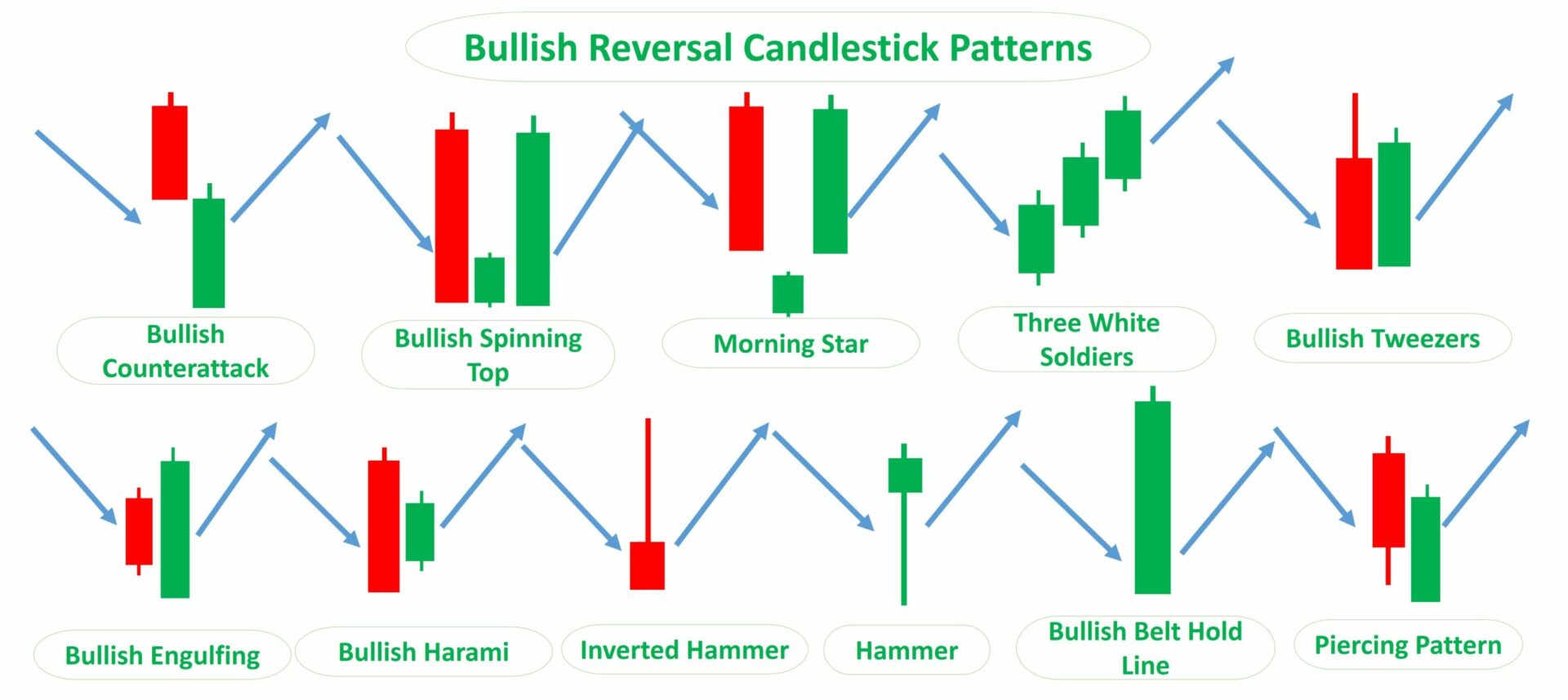

3 Bullish Candle Pattern - All three patterns indicate strong buying pressure and can be an entry signal for a bullish position. Web the pattern consists of three candles: Web this is considered a bearish continuation pattern. Some common mistakes when interpreting them. It turns out, perhaps surprisingly, that some candlestick patterns work reasonably well. Web this article shows you 3 bullish candlestick patterns that work. The hammer is a bullish candlestick pattern that indicates when a security is about to reverse upwards. Web three white soldiers is a bullish c andlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. It forms in a bullish trend and is believed to signal the continuation of the bullish trend. Web some of the most common bullish candlestick patterns include: Web the pattern consists of three candles: What these patterns look like. Some common mistakes when interpreting them. The decisive (fifth) strongly bullish. Web the third candlestick, also known as the trigger bar, is bullish, with an opening price at the same level as the second’s candle closing price and a closing price significantly above the second candle’s closing price. Web some of the most common bullish candlestick patterns include: Some common mistakes when interpreting them. First things first, we'll walk you through what a candlestick is and how to read candlestick charts. Long green or white candles showing buyers in control. Web the three white soldiers pattern is formed when three long bullish candles follow a downtrend, signaling a. It indicates a buying pressure, followed by a selling pressure that was not. Web on the weekly chart, kirloskar electric company has broken out above the rounded bottom pattern at 164 with a strong bullish candle, signalling the onset of the uptrend. How to set entries and risk for each. Web sep 25, 2023 12 min read. First things first,. Let’s start with some simpler bullish candlestick patterns — these usually consist of just a few candles and are very easy to spot — in fact, there are even indicators that spot these automatically on tradingview. What these patterns look like. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were. Web bullish reversal candlestick patterns: Web three white soldiers is a bullish c andlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. There is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Web sep 25, 2023 12 min read. Depending on their heights and collocation, a bullish. Web the three inside up pattern is a bullish reversal pattern composed of a large down candle, a smaller up candle contained within the prior candle, and then another up candle that closes above. Dragonfly doji and bullish engulfing patterns signaling a potential trend change. However, traders wait for the confirmation of the. For each pattern, we’ll cover: 3 bullish. You can find it on all chart timeframes. Web one candlestick pattern is the bullish three line strike. The decisive (fifth) strongly bullish. A similarly bullish pattern is the inverted hammer. Web the three white soldiers pattern is formed when three long bullish candles follow a downtrend, signaling a reversal has occurred. What story do they tell. Web the pattern consists of three candles: Dragonfly doji and bullish engulfing patterns signaling a potential trend change. Three line strike is a trend continuation candlestick pattern consisting of four candles. Web the pattern is confirmed by a bullish candle the next day. There is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Web three white soldiers is a bullish c andlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. Web the three outside up is a bullish candlestick pattern with the following characteristics: Dragonfly doji and bullish engulfing patterns. Morning star formations and bullish counterattack pattern indicating a. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern. Web what is a 3 bar reversal pattern? Here’s how to identify the three outside up candlestick pattern: The morning star candlestick pattern is considered a sign of hope in a. Web rising three methods is a bullish continuation candlestick pattern that occurs in an uptrend and whose conclusion sees a resumption of that trend. Three line strike is a trend continuation candlestick pattern consisting of four candles. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern. The market is in a downtrend. Web on the weekly chart, kirloskar electric company has broken out above the rounded bottom pattern at 164 with a strong bullish candle, signalling the onset of the uptrend. The decisive (fifth) strongly bullish. The first candle is bearish and small. Long green or white candles showing buyers in control. You can find it on all chart timeframes. Web the pattern consists of three candles: Web the pattern is confirmed by a bullish candle the next day. Web three white soldiers is a bullish c andlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. For each pattern, we’ll cover: Hammers and inverted hammers marking potential reversal points. Web the three most popular bullish candlestick patterns (and how to trade them) there are a lot of bullish candlestick patterns, but these three are especially popular among traders. This article will focus on the other six patterns.

Three outside up candlestick pattern. Candlestick chart Pattern For

Bullish Rising Three Methods Candlestick Candle Stick Trading Pattern

Candlestick Patterns The Definitive Guide (2021)

6 Reliable Bullish Candlestick Pattern TradingSim

Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Bullish candlestick chart pattern. Three Candle Patterns. Candlestick

How to read candlestick patterns What every investor needs to know

Bullish Candlestick Patterns PDF Guide Free Download

Top Reversal Candlestick Patterns

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish

We Test Bearish Engulfing Pattern, Three Outside Down, And Bullish Harami.

Morning Star Formations And Bullish Counterattack Pattern Indicating A.

Depending On Their Heights And Collocation, A Bullish Or A Bearish Trend Continuation Can Be Predicted.

Web Hammer (1) Inverted Hammer (1) Morning Star (3) Bullish Abandoned Baby (3) The Hammer And Inverted Hammer Were Covered In The Article Introduction To Candlesticks.

Related Post: