3 Black Crows Pattern

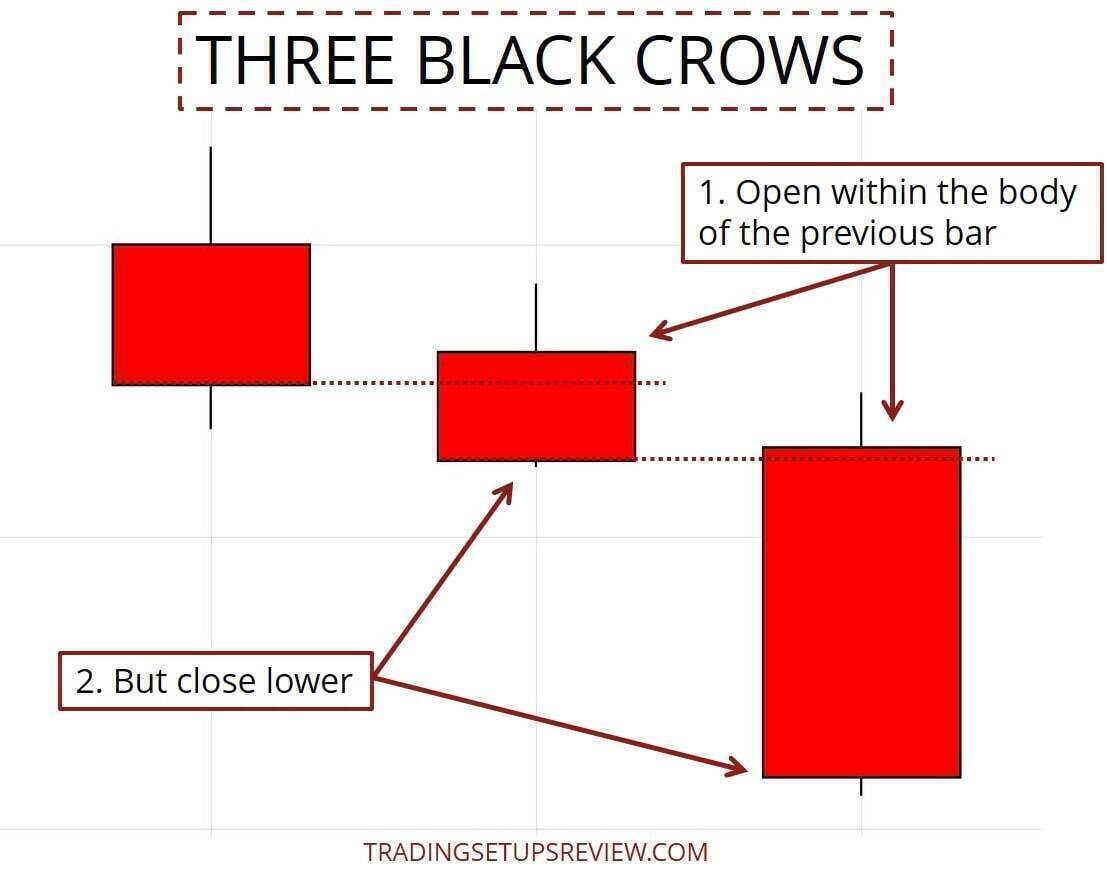

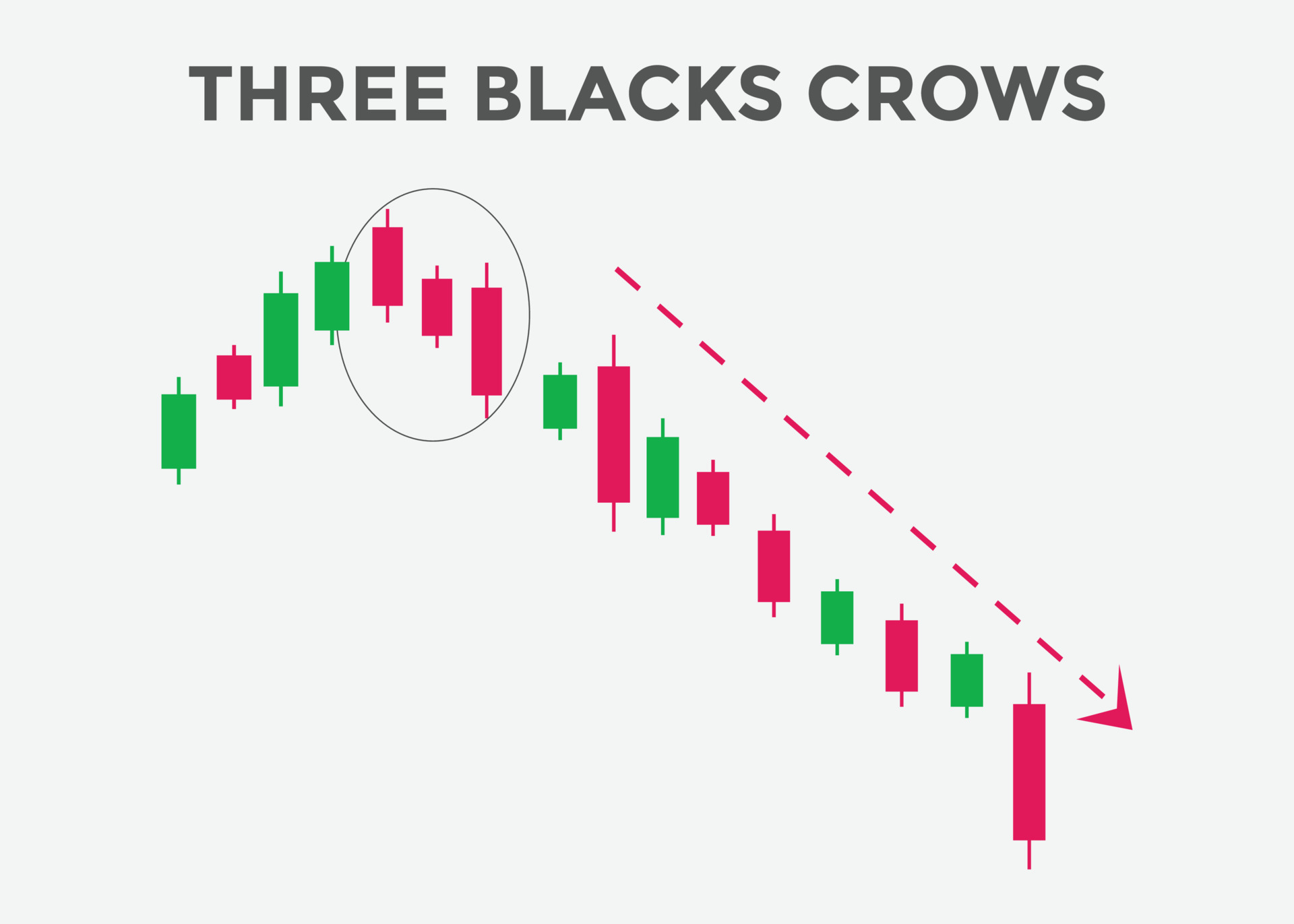

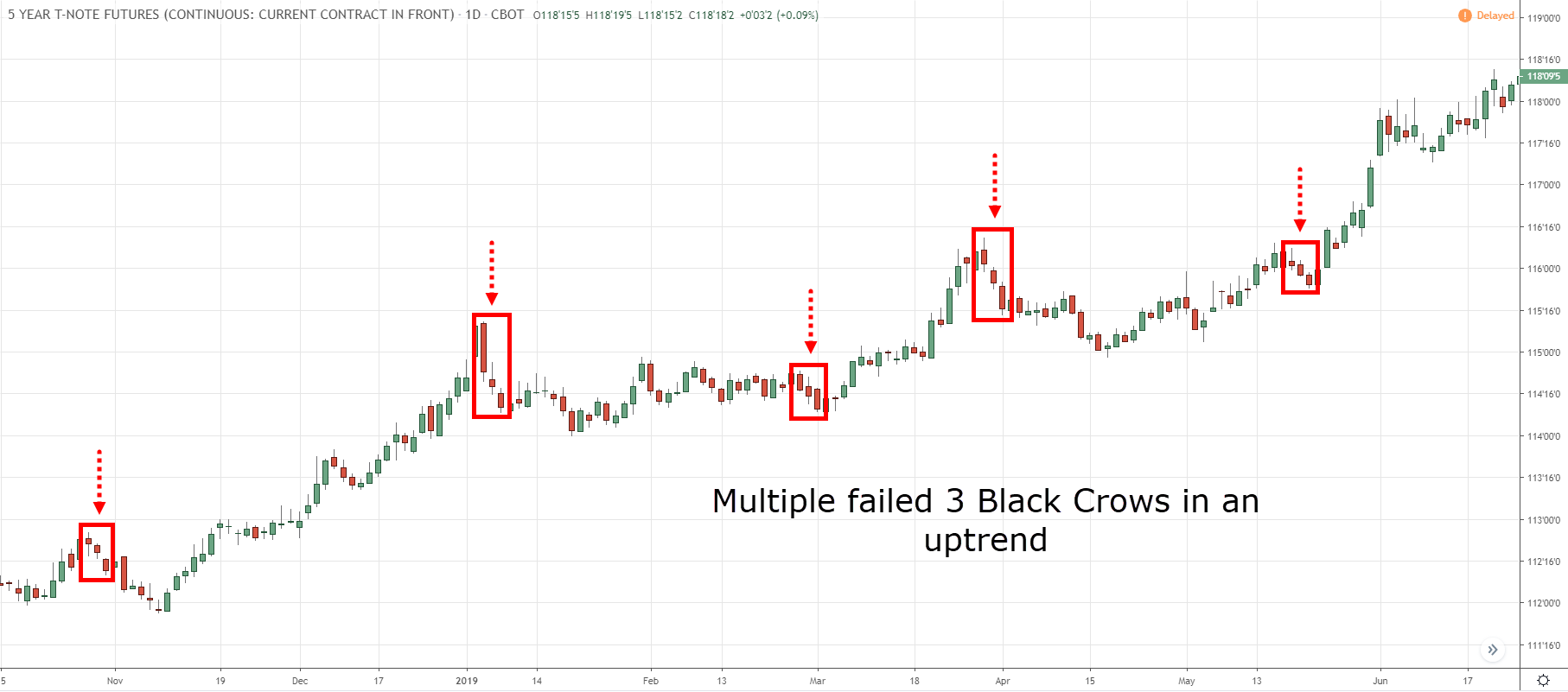

3 Black Crows Pattern - Bearish reversal pattern in the gbp/usd. The profit target can be based on the distance from the first candle's high to the third candle's low and adding the same to the. The three black crows pattern exclusively identifies selling opportunities in the market. The pattern will occur at major market tops when the market has been bullish for an extended period of time. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. The candlestick pattern that requires that each of the three candlesticks should be relatively long bearish candlesticks with each candlestick opening lower than the previous candle’s. Each candle in the pattern must open below the last days open, in the middle of the previous price. Web why the three black crows pattern has fooled many traders. In technical analysis, interpreting the three black crows pattern is much like deciphering a complex narrative of market sentiment. It unfolds across three trading sessions, and consists of three long candlesticks that trend downward like a staircase. Web three black crows is a bearish three candlestick chart pattern formed by price action closing lower than the open and below the previous day’s low for three days in row. The presence of the 3 black crows often signals that a reversal is imminent as downward price movement shows no real resistance in the pattern. The three black crows. Each candle in the pattern must open below the last days open, in the middle of the previous price. It is generally considered a bearish candlestick pattern that anticipated after an extended bullish uptrend. Web the three black crows is a bearish chart pattern that appears when bears overwhelm the bullish momentum for three trading sessions in a row. The. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. Each candle should open below the previous day's open, ideally. This is a bearish reversal formation which occurs near the top of the current uptrend, as it generates a reversal signal. Because the context of the market is more. In this guide, we will look closer at the three black crows pattern. Web decoding the three black crows: Web a few of the more common ratios used in the markets trading are 1:1, 1:2, 1:3, and 1:4. But at the same time, it also shows indicates exhaustion because. These candles must open within the previous body or near the. Web a pattern opposite the three white soldiers is called three black crows. Web why the three black crows pattern has fooled many traders. However, it should be noted that this pattern can. It appears on a candlestick chart in the financial markets. The middle and last candle opens within the bearish body of the previous candle and closes lower. Web september 7, 2022 zafari. One should note that these three candlesticks can be bearish marubozu. The presence of the 3 black crows often signals that a reversal is imminent as downward price movement shows no real resistance in the pattern. Web how to trade the three black crows pattern ?this pattern is powerful if you recognise it properly.many people. The three black crows pattern is identified as a bearish candlestick pattern used to predict a. To better understand the three black crows you’ve spotted, keep an eye on the candles’ lengths. Web how a three black crows pattern is interpreted. Day one closed at $50 with a gap down from an open of $52.day two continued with an open. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. Web how a three black crows pattern is interpreted. Web decoding the three black crows: The second and third candles must be approximately the same size, to show that the bears are firmly in control. The pattern will occur. Day one closed at $50 with a gap down from an open of $52.day two continued with an open at $49.50 and closed at $47, and day three solidified the pattern with an opening at $46.50 and a closing at $44. The presence of the 3 black crows often signals that a reversal is imminent as downward price movement shows. But at the same time, it also shows indicates exhaustion because. The profit target can be based on the distance from the first candle's high to the third candle's low and adding the same to the. The pattern will occur at major market tops when the market has been bullish for an extended period of time. The 3 black crows’. The three black crows pattern is a reversal indicator; Web why the three black crows pattern has fooled many traders. The 3 black crows’ meaning or significance is just a small part of your trading analysis. As with the bullish formation, the three black crows consists of three consecutive bearish candles, preferably with long bodies, that takes the price. Web three black crows is a bearish three candlestick chart pattern formed by price action closing lower than the open and below the previous day’s low for three days in row. Each candle should open below the previous day's open, ideally. Each candle in the pattern must open below the last days open, in the middle of the previous price. In a three black crows pattern, each candle closes lower than the one before, marking an aggressive move by the bears to drive the price back and. On september 14, 2023, the stock of xyz corporation formed a perfect example of the three black crows. The pattern will occur at major market tops when the market has been bullish for an extended period of time. Web september 7, 2022 zafari. The “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. If the third candle is clearly smaller than the others, this. In this guide, we will look closer at the three black crows pattern. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. One should note that these three candlesticks can be bearish marubozu.

What Are Three Black Crows Candlestick Patterns Explained ELM

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

Three Black Crows Pattern All You Need to Know Phemex Academy

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

How To Trade The Three Black Crows Pattern

Three Black Crows Hit & Run Candlesticks

Three Black Crows candlestick pattern. Powerful bearish Candlestick

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

The Three Black Crows Candlestick Pattern Premium Store

What Are Three Black Crows Patterns Explained ELM

The Three Black Crows Pattern Exclusively Identifies Selling Opportunities In The Market.

Day One Closed At $50 With A Gap Down From An Open Of $52.Day Two Continued With An Open At $49.50 And Closed At $47, And Day Three Solidified The Pattern With An Opening At $46.50 And A Closing At $44.

Three Crows Is A Term Used By Stock Market Analysts To Describe A Market Downturn.

It Unfolds Across Three Trading Sessions, And Consists Of Three Long Candlesticks That Trend Downward Like A Staircase.

Related Post: