3 Black Crows Candlestick Pattern

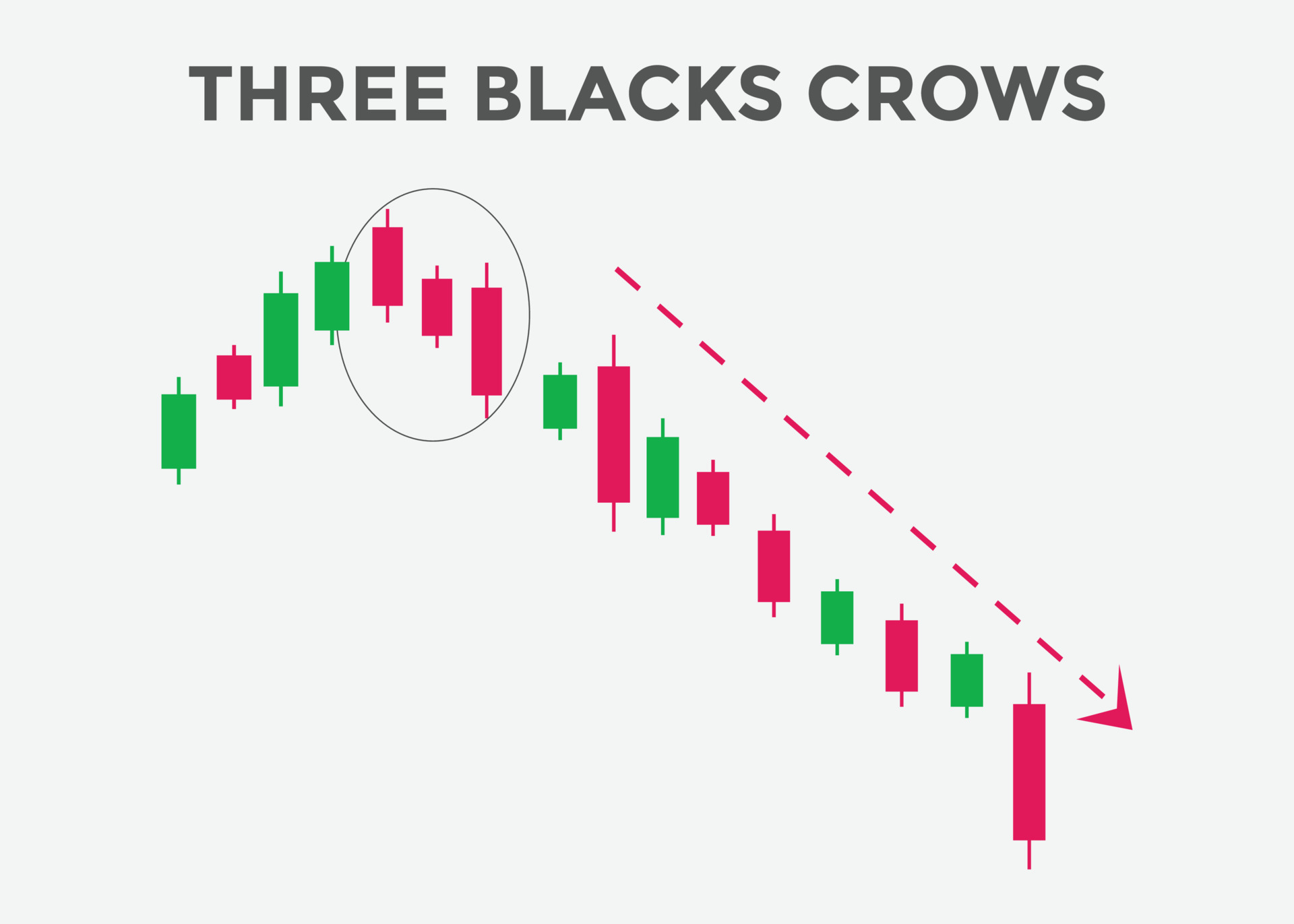

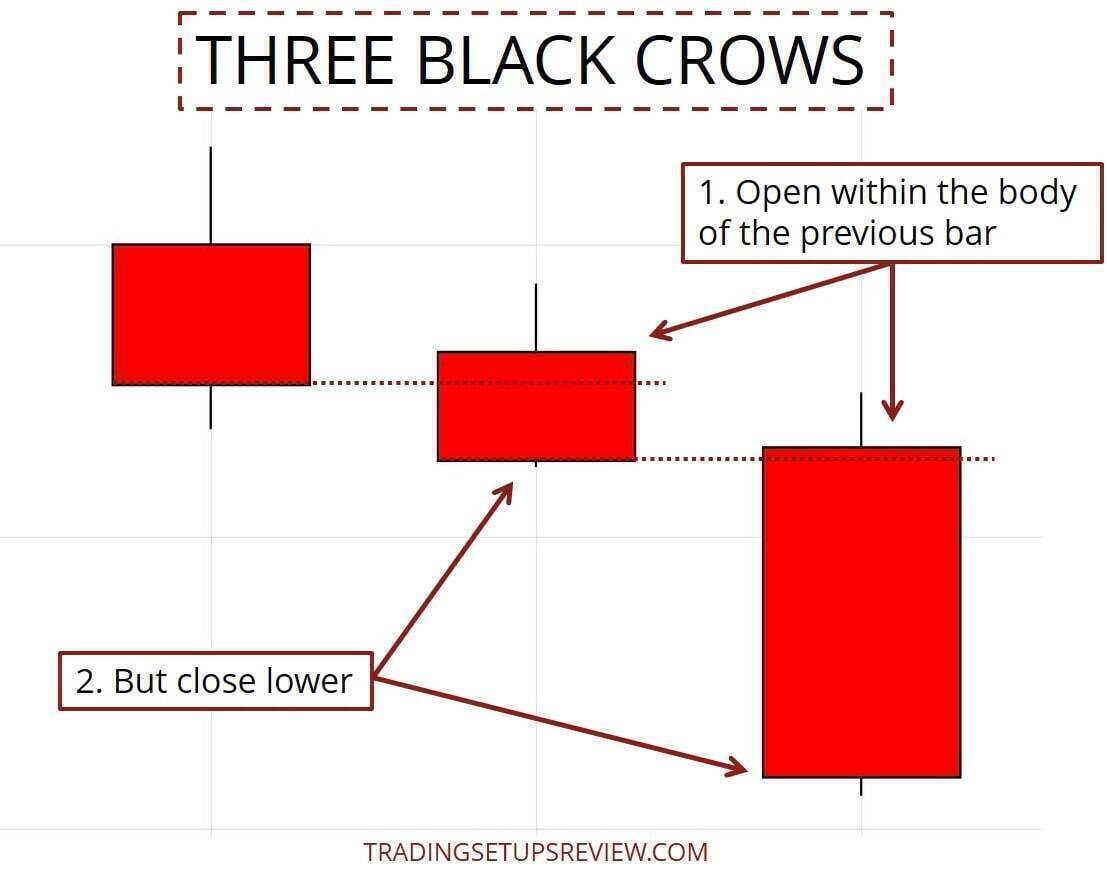

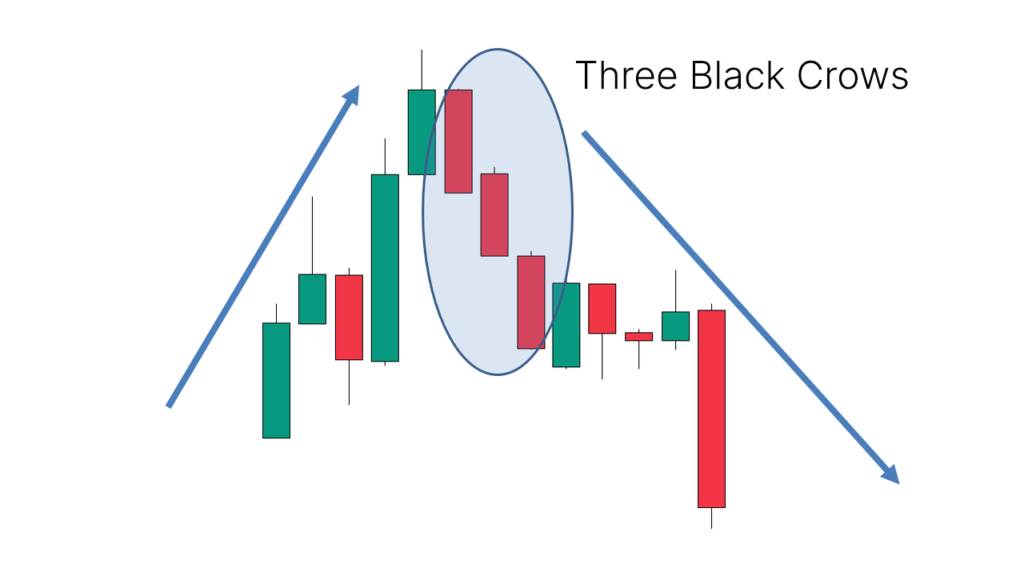

3 Black Crows Candlestick Pattern - Web candlestick patterns have become one of the most popular analysis methods available today, and there are quite a variety of patterns available, each holding a different meaning. This pattern is considered a reliable indicator of a potential reversal of an uptrend or bullish market sentiment. Candles can have little or no shadows. However, it should be noted that this pattern can. Web the three black crows can signal a change in market sentiment from positive to negative. This is a bearish reversal formation which occurs near the top of the current uptrend, as it generates a reversal signal. Three black crows candlestick pattern #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick.. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. Before the “three black crows,” there is a small downtrend, two tiny candles moving upward, and then the signal. One should note that these three candlesticks can be bearish marubozu. Web three black crows is a term used in technical analysis to describe a pattern of consecutive bearish candlesticks on a price chart. It is generally considered a bearish candlestick pattern that anticipated after an extended bullish uptrend. Qualify each candle’s short upper shadow and low close relative to the previous candle. Locate three consecutive bearish candles. This pattern is. Stay updated with the latest trends and insights in the finance world. Its second line is classified as a long black candle (basic candle), being at the same time considered as a bearish strong line pattern. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. This pattern is. It is generally considered a bearish candlestick pattern that anticipated after an extended bullish uptrend. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. The 3 black crows’ meaning or significance is just a small part of your trading analysis. Web three black crows is a term used. Before the “three black crows,” there is a small downtrend, two tiny candles moving upward, and then the signal. Web september 7, 2022 zafari. Web three black crows is a term used in technical analysis to describe a pattern of consecutive bearish candlesticks on a price chart. It unfolds across three trading sessions, and consists of three long candlesticks that. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. Three black crows candlestick pattern #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick.. Web candlestick patterns have become one of the most popular analysis methods available today, and there are quite. Understand the significance of each pattern in market analysis. #binance #bybit #bitcoin #ethereum #crypto #cryptocurrency #trading”. The candlestick pattern that requires that each of the three candlesticks should be relatively long bearish candlesticks with each candlestick opening lower than the previous. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after. Follow these steps to identify and trade three black crows: One might debate whether our third example qualifies as a three black crows candlestick pattern. Web how to trade the three black crows pattern ?this pattern is powerful if you recognise it properly.many people teach this by generalising the rules a bit, whi. Understand the significance of each pattern in. Each candle should open below the previous day's open, ideally. This pattern is considered a reliable indicator of a potential reversal of an uptrend or bullish market sentiment. Web the 3 black crows pattern indicates a reversal or continuation. Web three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend. Before. Before the “three black crows,” there is a small downtrend, two tiny candles moving upward, and then the signal. Web how a three black crows pattern is interpreted. In a way, it lacks the very first criteria we mentioned above: Three black crows candlestick pattern #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick.. Web september 7, 2022 zafari. Locate three consecutive bearish candles. Three crows is a term used by stock market analysts to describe a market downturn. It is generally considered a bearish candlestick pattern that anticipated after an extended bullish uptrend. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web a pattern opposite. Web the three black crows pattern is the opposite of the three advancing white soldiers candlestick pattern.the three black crows candlestick pattern is a bearish reversal pattern that consists of three bearish candlesticks that are ominous and dark in color, hence the name. “master the art of recognizing and utilizing the powerful candlestick pattern 3 black crows in your trading strategy. Stay updated with the latest trends and insights in the finance world. Web three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend. Before the “three black crows,” there is a small downtrend, two tiny candles moving upward, and then the signal. Web september 7, 2022 zafari. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Recognize an uptrend in price. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. One should note that these three candlesticks can be bearish marubozu. Locate three consecutive bearish candles. Understand the significance of each pattern in market analysis. This is a bearish reversal formation which occurs near the top of the current uptrend, as it generates a reversal signal. The pattern will occur at major market tops when the market has been bullish for an extended period of time. This pattern is also known as “3 black crows” and is the opposite of three white soldiers pattern. Learn to identify over 50 candlestick chart patterns.

How To Trade The Three Black Crows Pattern

What Are Three Black Crows Patterns Explained ELM

Three Black Crows candlestick pattern. Powerful bearish Candlestick

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

Three Black Crows Candlestick Pattern What Is And How To Trade

Candlestick Patterns The Definitive Guide (2021)

What Is The Three Black Crows Candlestick Pattern & How To Trade With

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

What Are Three Black Crows Candlestick Patterns Explained ELM

Web Three Black Crows Candlestick Pattern Indicates Rising Trend Momentum (During Downtrend) Or An Increased Possibility For Uptrend Reversal (During Positive Market Movements).

Just Because The Market Has Closed Lower 3 Days In A Row Doesn’t Mean The Uptrend Will Reverse.

The Three Black Crows Pattern Is Identified As A Bearish Candlestick Pattern Used To Predict A.

It Is Based On The Candlestick Charting Method, Formed By Three Consecutive Black Candles In A Row.

Related Post: