13-Week Cash Flow Template

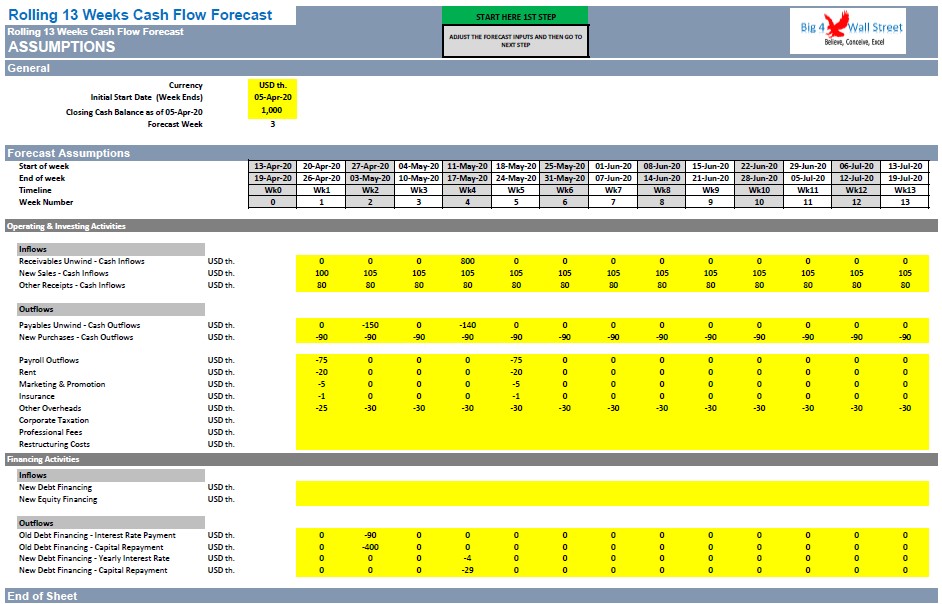

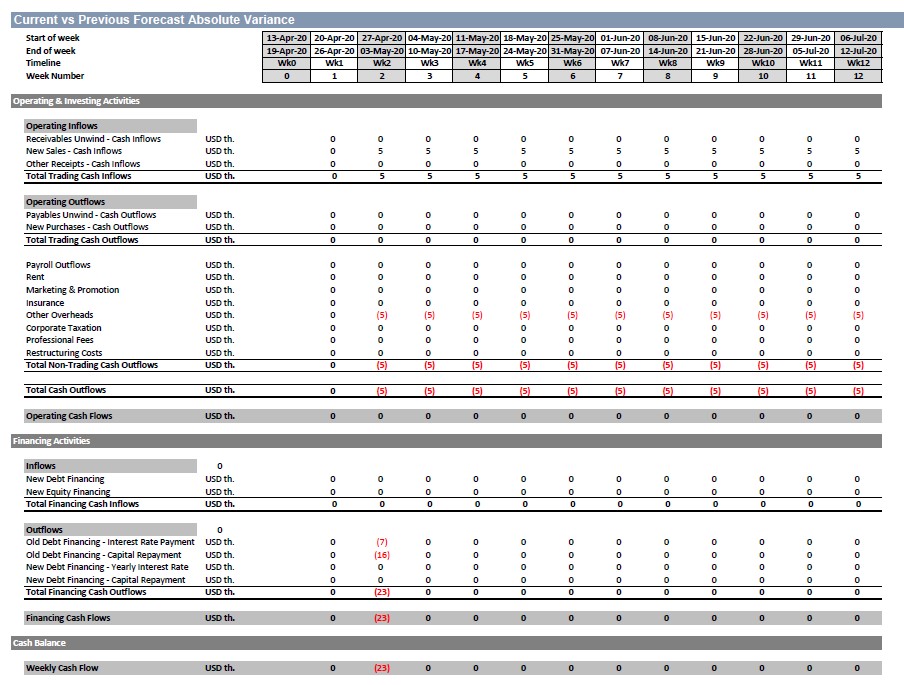

13-Week Cash Flow Template - Here’s an explanation of the template: Use it to avoid closing your doors forever. How to create a 13 week cash flow model step 1: Web unlike most longer term forecasts, you can and should begin a thirteen week cash flow by using a template. While that sounds simple, running out of money is one of the most common reasons why new businesses close down in the first five years. Web check out growthlab’s cash flow template. It is a spreadsheet to forecast your cash expectations. Gain weekly insights at stakeholder level. Web a cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. All numbers and cells in blue are inputs to the spreadsheet. Web a cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. Web check out growthlab’s cash flow template. Here’s an explanation of the template: This is the exact format i use with clients. Businesses die when they run out of money. Quarterly cash flow projections template; Web income statement template; Web here is the template in xls: Web the 13 week cash flow model tracks cash inflow and outflow, focusing on customer collections, prepayments, variable costs, fixed costs, and other expenses in a business. Gain weekly insights at stakeholder level. Quarterly cash flow projections template; All numbers and cells in blue are inputs to the spreadsheet. It shows your starting cash, the cash rolling in, and the cash going out. Web the 13 week cash flow model tracks cash inflow and outflow, focusing on customer collections, prepayments, variable costs, fixed costs, and other expenses in a business. If you work. Web 13 week cash flow when setting up a new cash forecasting model, time horizons should be chosen intentionally. Web here is the template in xls: How to create a 13 week cash flow model step 1: It is a spreadsheet to forecast your cash expectations. It shows your starting cash, the cash rolling in, and the cash going out. Web income statement template; Web 13 weeks is the most popular cash forecasting time horizon. While that sounds simple, running out of money is one of the most common reasons why new businesses close down in the first five years. Web here is the template in xls: Web 13 week cash flow when setting up a new cash forecasting model,. Web 13 weeks is the most popular cash forecasting time horizon. 13 weeks is short enough time to be precise. As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting cash disbursements (outflows) from cash receipts (inflows) for every week. Download how to use the sheet start by entering. Web income statement template; A 13 week cash flow model should not have complex formulas. Web february 26, 2021 the cashflow template is built off a set of assumptions for your business. This video explains how and includes a free cash flow template. Web your business is evolving at a rapid pace. Businesses die when they run out of money. This is the exact format i use with clients. Web check out growthlab’s cash flow template. This template is a powerful tool that allows you to project incoming and outgoing cash, helping you to visualize your financial situation over the next quarter. While that sounds simple, running out of money is one. 13 weeks is short enough time to be precise. Web income statement template; A 13 week cash flow model should not have complex formulas. How to create a 13 week cash flow model step 1: Web the 13 week cash flow model tracks cash inflow and outflow, focusing on customer collections, prepayments, variable costs, fixed costs, and other expenses in. Use it to avoid closing your doors forever. Web 13 weeks is the most popular cash forecasting time horizon. Here’s an explanation of the template: In 45 minutes, we'll walk through the structure of a 13 week cash flow template that starts with your personal life and ends with a business case. Web a cash flow forecasting template allows you. How to create a 13 week cash flow model step 1: Web check out growthlab’s cash flow template. Web 13 week cash flow when setting up a new cash forecasting model, time horizons should be chosen intentionally. Web a cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. The template consists of two divisions: 13 weeks is short enough time to be precise. This template is a powerful tool that allows you to project incoming and outgoing cash, helping you to visualize your financial situation over the next quarter. Quarterly cash flow projections template; It is a spreadsheet to forecast your cash expectations. This is the exact format i use with clients. Gain weekly insights at stakeholder level. This video explains how and includes a free cash flow template. Web february 26, 2021 the cashflow template is built off a set of assumptions for your business. As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting cash disbursements (outflows) from cash receipts (inflows) for every week. Web here is the template in xls: Use it to avoid closing your doors forever.

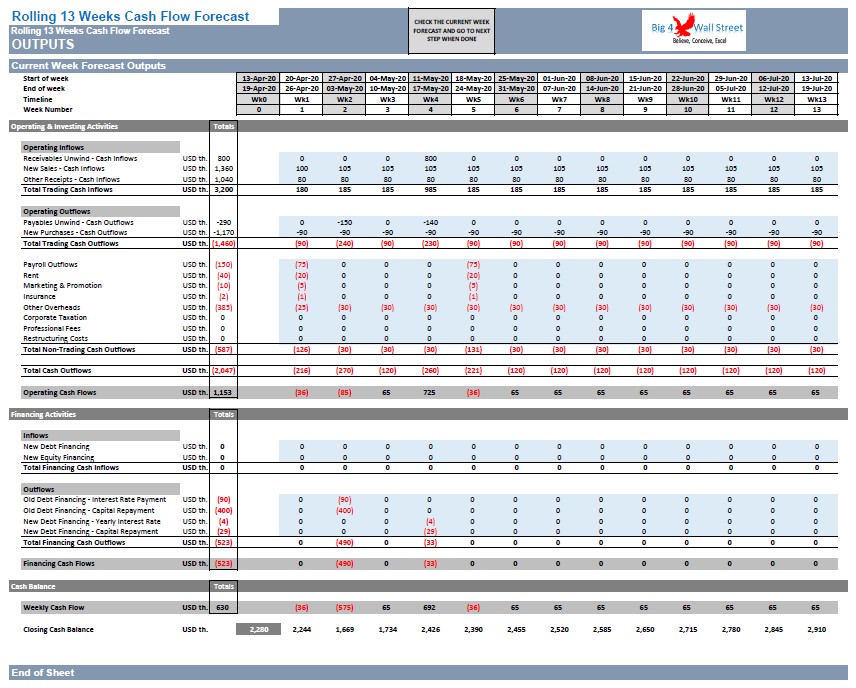

Rolling 13 Weeks Cash Flow Excel Template Eloquens

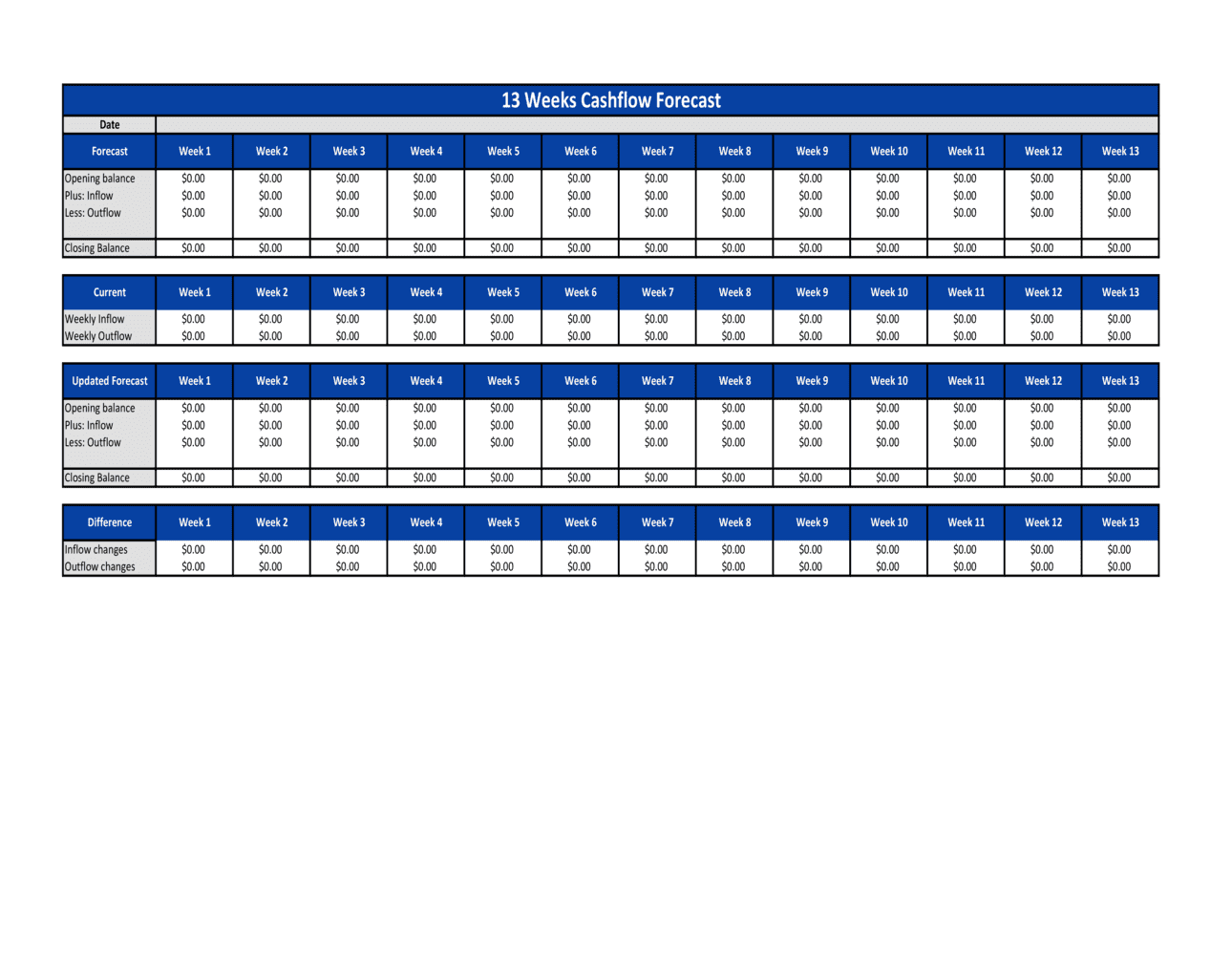

13 Weeks Cashflow Forecast Template by BusinessinaBox™

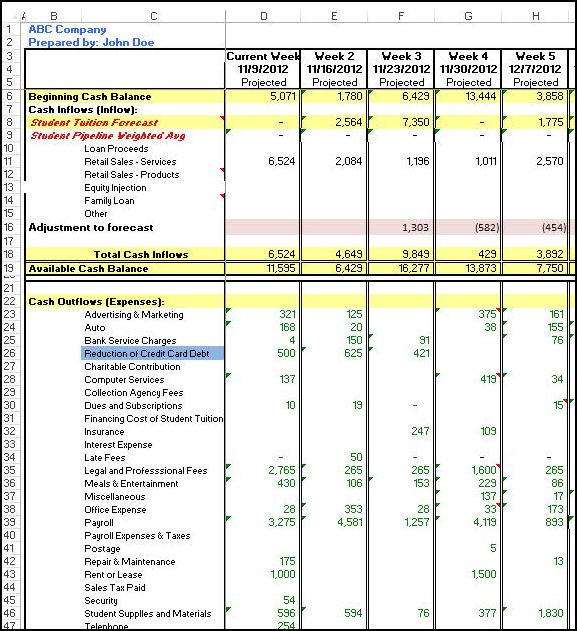

13 Week Cash Flow Forecast Template Excel

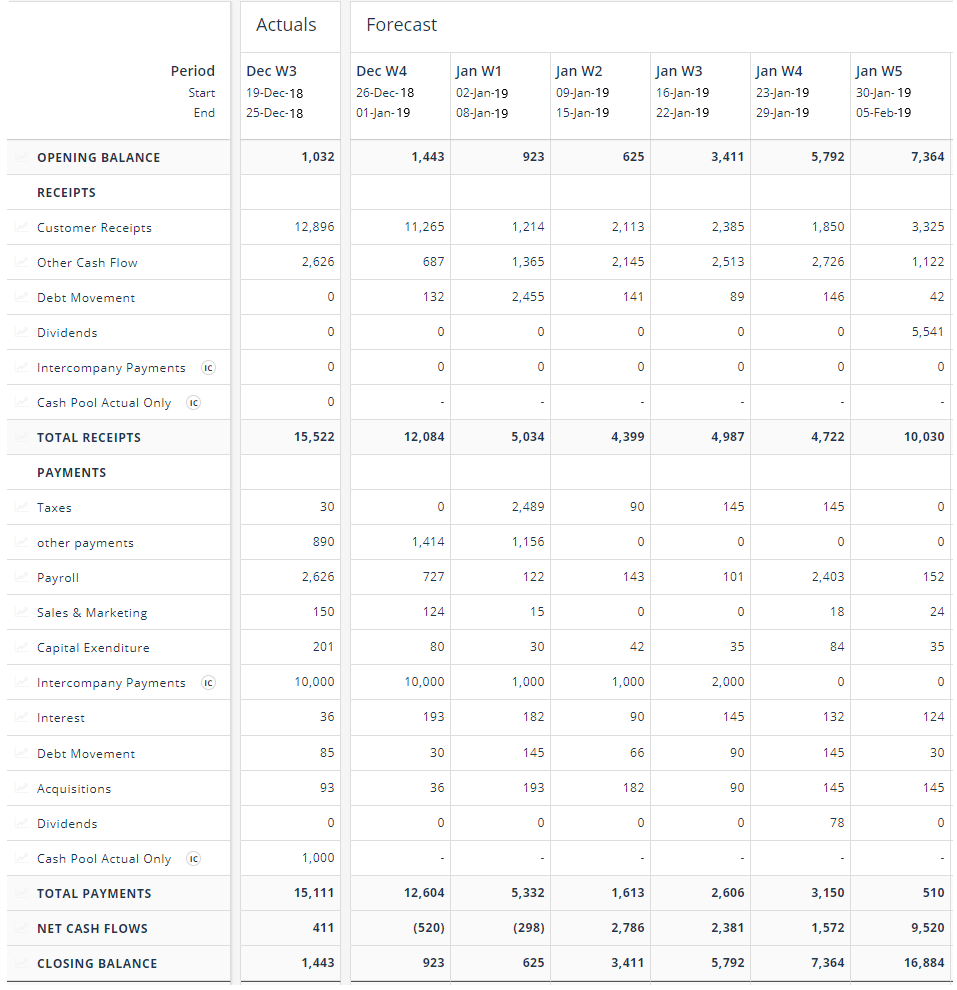

Demystifying the 13 Week Cash Flow Model in Excel Wall Street Prep

Free 13 Week Cash Flow Template Excel

Rolling 13 Weeks Cash Flow Excel Template Eloquens

Demystifying the 13 Week Cash Flow Model in Excel Wall Street Prep

13Week Cash Flow Model (TWCF) Template Example

13Week Cash Flow Model (TWCF) Template Example

Rolling 13 Weeks Cash Flow Excel Template Eloquens

Businesses Die When They Run Out Of Money.

While That Sounds Simple, Running Out Of Money Is One Of The Most Common Reasons Why New Businesses Close Down In The First Five Years.

Web The 13 Week Cash Flow Model Tracks Cash Inflow And Outflow, Focusing On Customer Collections, Prepayments, Variable Costs, Fixed Costs, And Other Expenses In A Business.

It Shows Your Starting Cash, The Cash Rolling In, And The Cash Going Out.

Related Post: