1099 Form Printable Free

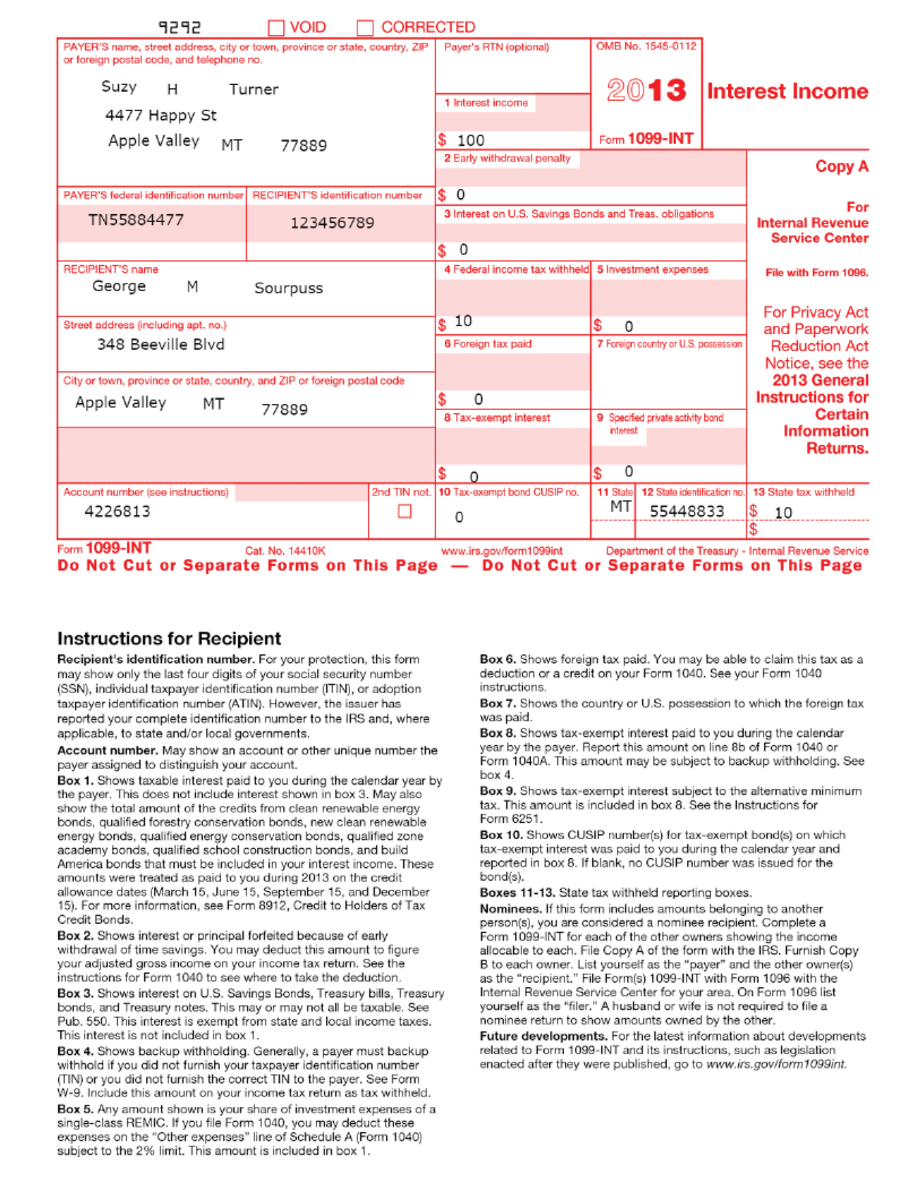

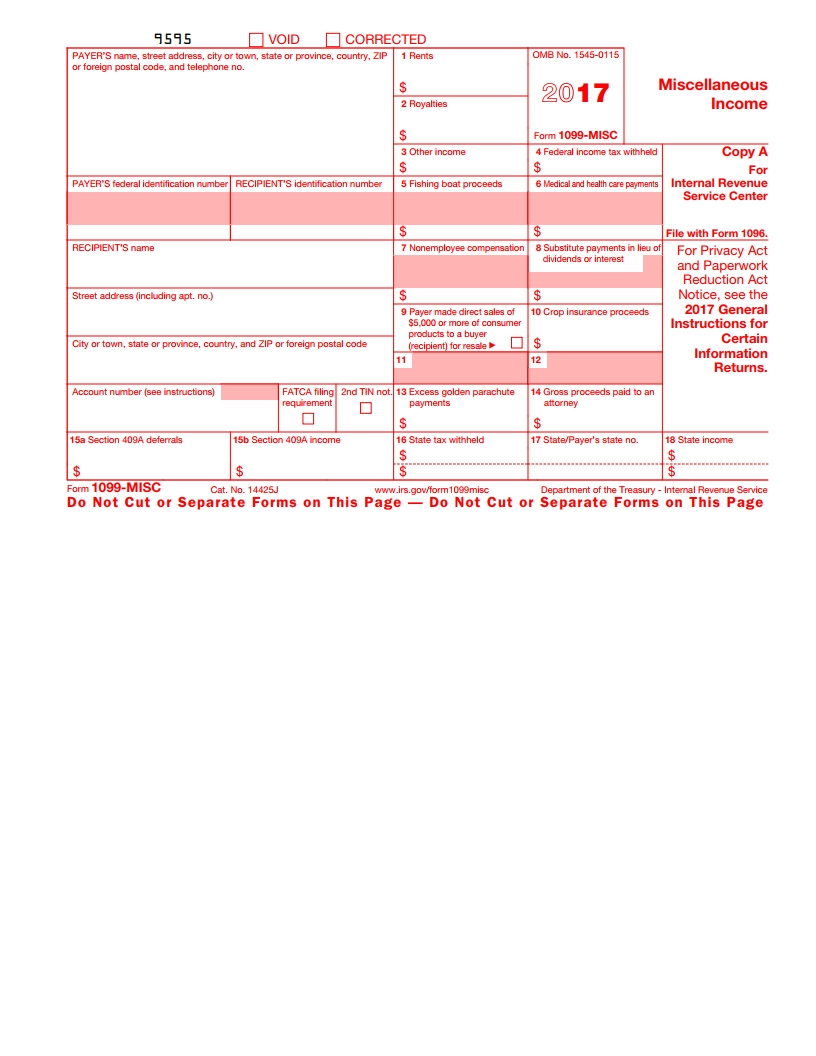

1099 Form Printable Free - See the instructions for form 8938. Web if you need help estimating how income on a form 1099 could affect your tax bill, check out our free tax calculator. Web get a printable 1099 tax form for the 2023 tax year. If you work as an independent contractor or freelancer, you'll likely have income. 1099s fall into a group of tax documents. 1099 forms can report different types of incomes. There are 20 active types of 1099 forms used for various income types. Select each contractor you want to print 1099s for. File your 1099 with the irs for free using freetaxusa. For filling out taxes on income earned from 1/1/2023 to 12/31/2023. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Here you can find everything related to form 1099: There are 20 active types of 1099 forms used for various income types. Free template for print, sample, and filled out example. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See the instructions for form 8938. Web get a printable 1099 tax form for the 2023. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Web 10 or more returns: Here you can find everything related to form 1099: Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. For filling out taxes. You will also have a copy you can send to your state tax department, if required. Get free support and guidance from our experts. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received. Persons with a hearing or speech disability with access to tty/tdd equipment can. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Click “print 1099” or “print 1096” if you only want that form. 1099 forms can report different types. Web irs 1099 form. However, the issuer has reported your. You will also have a copy you can send to your state tax department, if required. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. You may also have a filing requirement. Post the nonemployee compensation and. List your company’s taxpayer identification number (tin) as payer’s tin. You will also have a copy you can send to your state tax department, if required. However, the issuer has reported your. Send out these 1099 forms after you review them for accuracy and completeness. File your 1099 with the irs for free using freetaxusa. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). All kinds of. You may also have a filing requirement. Web recipient’s taxpayer identification number (tin). Fill, generate & download or print copies for free. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. However, the issuer has reported your. Here you can find everything related to form 1099: See your tax return instructions for where to report. All kinds of people can get a 1099 form for different reasons. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. For filling out taxes on income earned from 1/1/2023 to 12/31/2023. You may also have a filing requirement. Post the nonemployee compensation and. Make sure you’ve got the right paper in your printer. Web get a printable 1099 tax form for the 2023 tax year. Persons with a hearing or speech disability with access to tty/tdd equipment can. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Provide form 1099 to independent contractors & file with irs. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Send out these 1099 forms after you review them for accuracy and completeness. See the instructions for form 8938. You should issue all other payments to the recipient by. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web if you need help estimating how income on a form 1099 could affect your tax bill, check out our free tax calculator.![]()

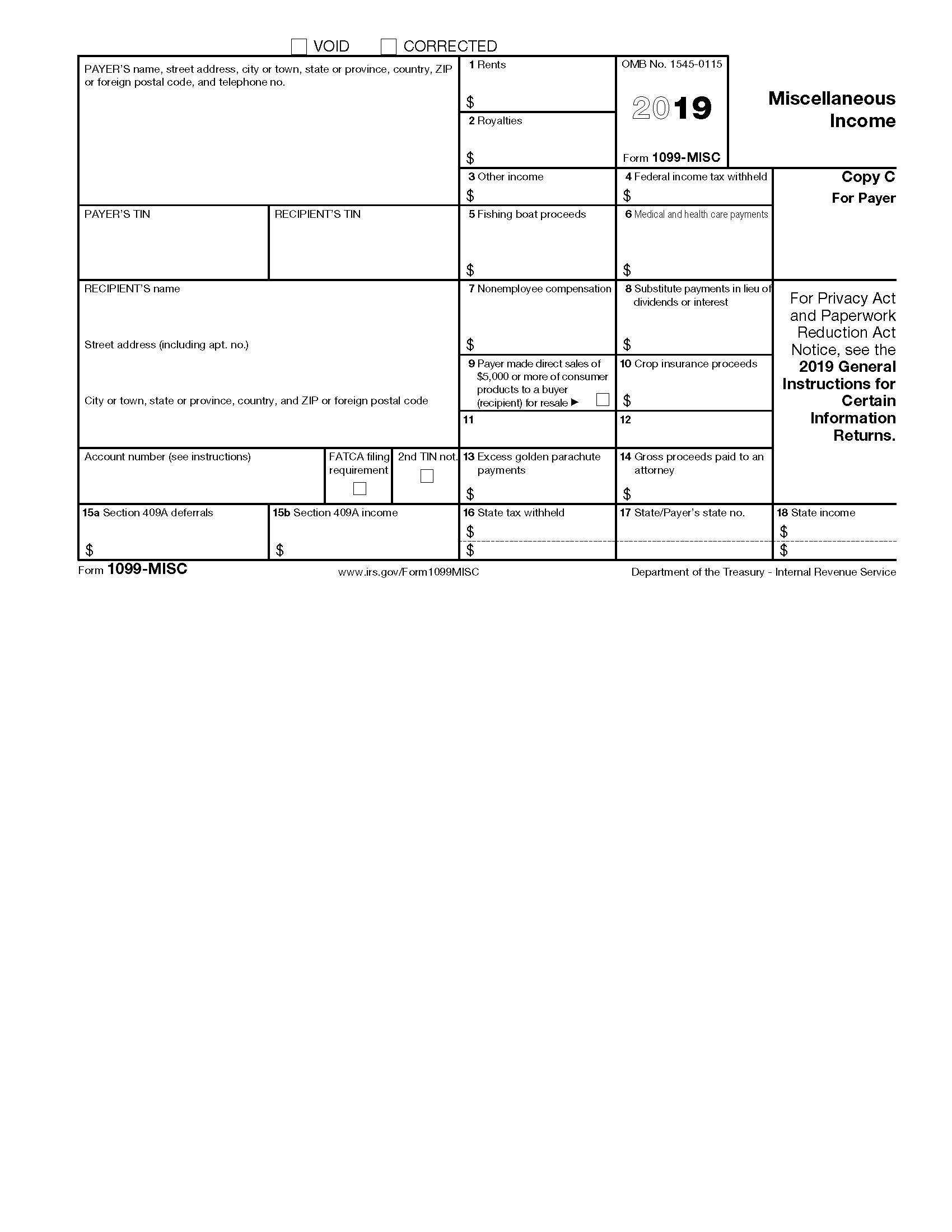

Printable 1099 Form Pdf Free Printable Download

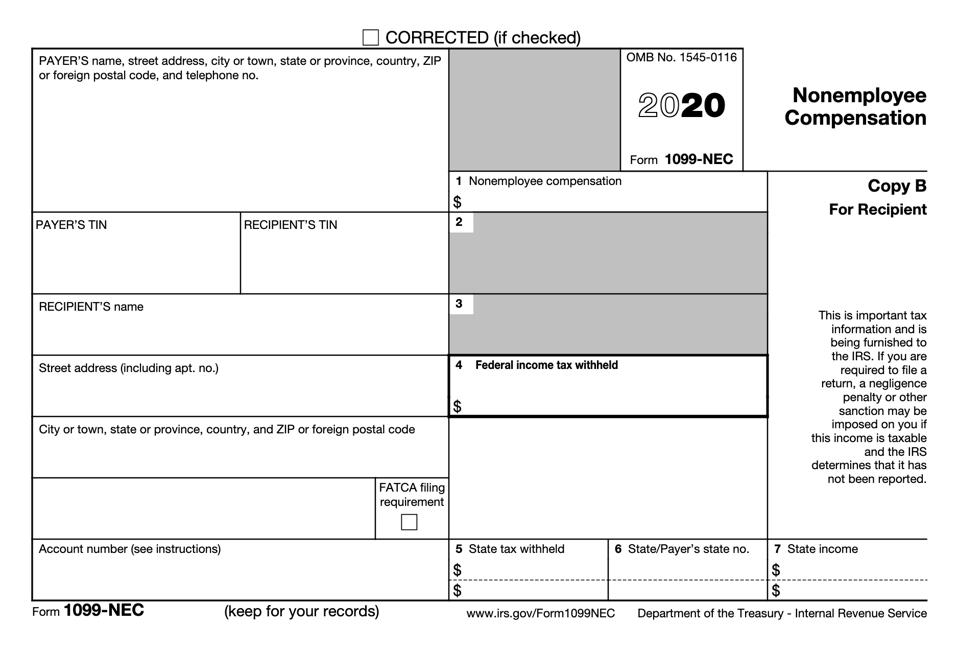

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Form Independent Contractor Pdf Blank Contractor Agreement

1099 Contract Template HQ Printable Documents

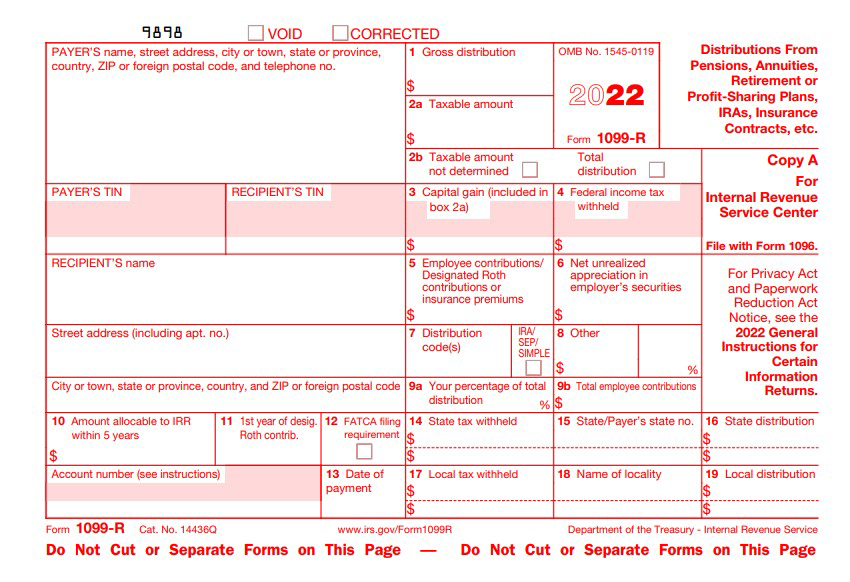

What is a 1099R Form Distributions from Pensions & Annuities

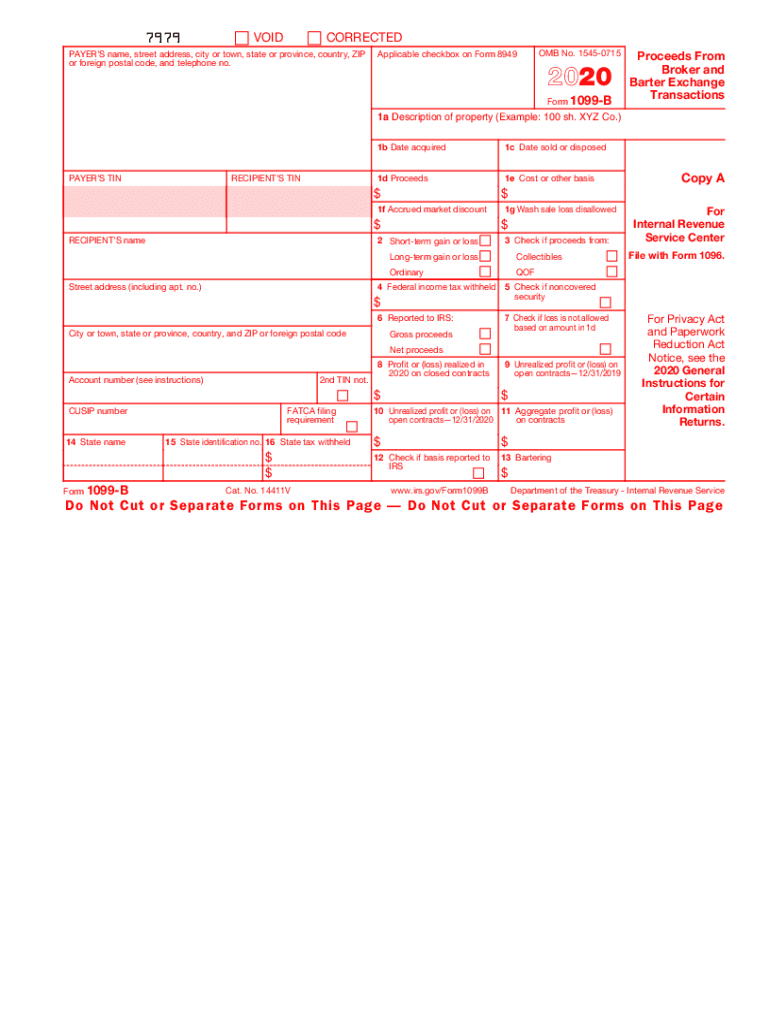

2020 Form IRS 1099B Fill Online, Printable, Fillable, Blank pdfFiller

1099 Form Template. Create A Free 1099 Form Form.

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

Download Fillable 1099 Form Printable Forms Free Online

What is a 1099Misc Form? Financial Strategy Center

List Your Company’s Taxpayer Identification Number (Tin) As Payer’s Tin.

Fill, Generate & Download Or Print Copies For Free.

File Your 1099 With The Irs For Free Using Freetaxusa.

Note That The $600 Threshold That Was Enacted.

Related Post: